Step 2: Credit out the invoice advanceĪ counterparty creation response will notify you that everything has been successfully set up. This information might include a unique customer ID, the way in which they signed up, and other information. In addition to the account and routing number, you might want to hold additional information about the counterparty held in metadata. Step 1: Collect bank account details 1 curl -request POST \ This can be done using Plaid or by having the user fill out a form (see more here on different ways to authenticate accounts). When Billy signs up for the service, Invoice.ly creates a Counterparty in Modern Treasury and gathers bank account details. Depending on the rules it agreed on with its own investors, maybe Invoice.ly “recycles” those funds a set amount of times before returning them to investors, or maybe it cycles indefinitely. When the invoice is paid, it retrieves those funds into the Repayment account. When Invoice.ly approves an invoice, it sends funds from the Funding account. So suppose Invoice.ly sets up two accounts with its bank: a Funding account and a Repayment account. But oftentimes companies choose to separate these functions into two separate accounts, for simplicity of accounting and payment ops. Invoice.ly needs a bank account to fund the invoices and receive payments. With this experience in mind, let’s plan out the payment operations for Invoice.ly.

INVOICE FACTORING ONLINE FULL

Invoice.ly sends funds equal to 90% of the invoice to Billy’s bank account.Billy uploads an invoice that was issued recently.A user, Billy, comes to the Invoice.ly website and is approved for all future invoices.Note that this is a fairly simple case oftentimes there’s a payment plan associated with an invoice, and in such cases there might be a repayment plan that mirrors those timings on the invoice factoring arrangement as well.įor the simple case, the steps we need to build out are: Then, 90 days later, when the buyer pays the full invoice, Invoice.ly will receive the full $1000. That means that when a business owner Billy sells $1000 worth of goods and issues an invoice, Invoice.ly will send $900 to Billy. The User Experienceįor simplicity, let’s assume Invoice.ly offers 90% advance rate on any invoice that is to be paid in 90 days. But the payment operations are similar between these companies, and this post will outline what they might look like in a few API calls.īut first, let’s outline the user experience our new invoice factoring company, Invoice.ly, might want to build.

Both will change over time and be specific to each company. It does not touch on credit criteria or the underwriting model required for a specific industry.

INVOICE FACTORING ONLINE HOW TO

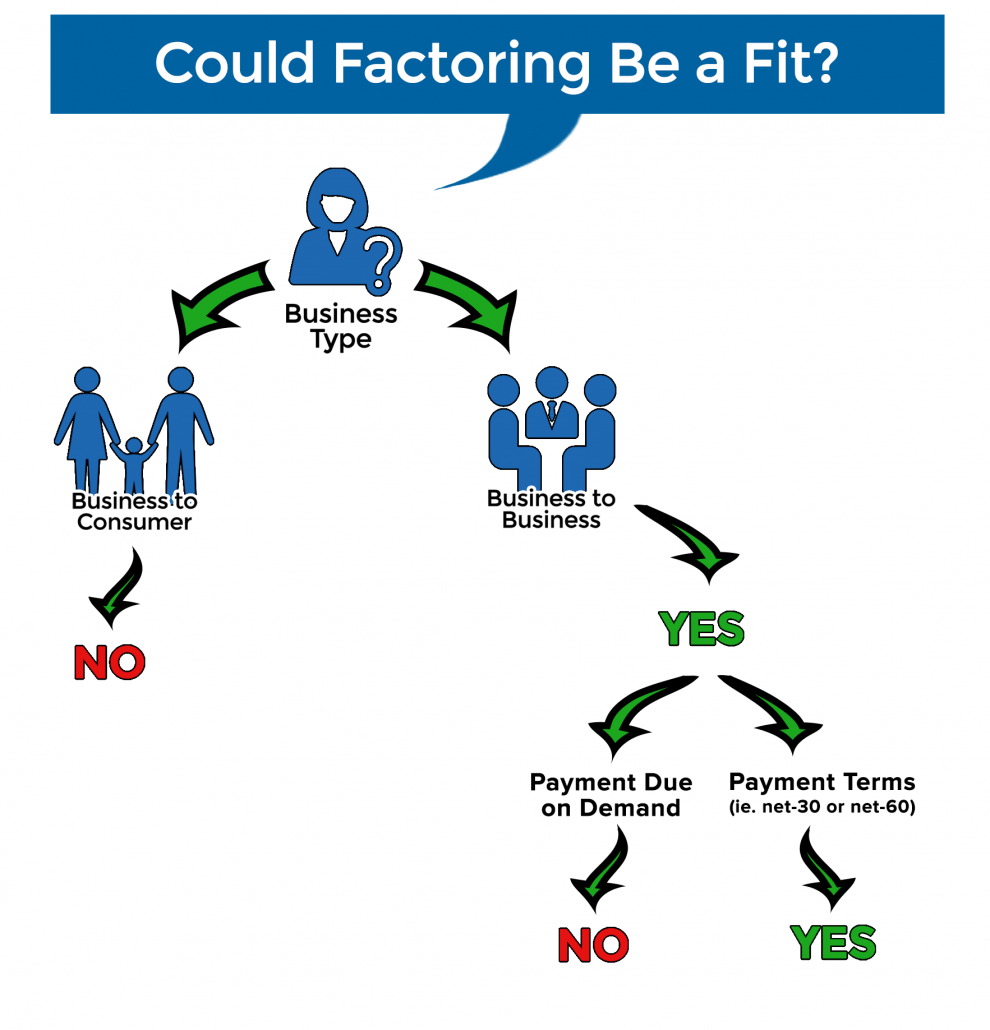

This post describes how to build the payment operations required for an invoice factoring company. Examples include BlueVine, Fundbox, Affirm, and Pipe. And because understanding how likely the customer is to pay the invoice requires an understanding of a specific industry and its contracts, accounts receivable factoring companies oftentimes specialize in specific industries. From a lender perspective, this type of loan is not quite as safe as collateralized loans against something such as a house, but it’s more secure than an unsecured personal loan, because it relies on an existing contractual obligation to pay that a customer has agreed to. Invoice factoring advances cash against invoices a company has issued, effectively prepaying the funds that a company’s customers have promised to pay in 30, 60, or 90 days. And these days, as more commerce moves online, there’s a new crop of online financing companies that take the form of lending often referred to as invoice factoring.

INVOICE FACTORING ONLINE CODE

Running a growing business, especially a small business, comes with cash flow challenges that have faced entrepreneurs since the dawn of commerce-so much so that some of the earliest writing ever discovered, in the Mesopotamian Code of Hammurabi, codifies how small business financing should be done.

0 kommentar(er)

0 kommentar(er)